Table of Contents

- New Bracket Thresholds, Rising Contribution Limits, and Other Tax ...

- 2024 tax brackets: IRS inflation adjustments could save you money

- The IRS’s New 2024 Tax Brackets: Inflation Adjustment Could Save ...

- IRS Announces New 2024 Income Tax Brackets - Enlighten567

- Tax Brackets 2024 Vs 2024 Nj - Rasla Cathleen

- Important Tax Numbers for 2024 | Boston Financial Management

- New Tax Changes For 2024 - Mary Starla

- Tax Brackets Single 2024 - Wally Jordanna

- 2024 Income Tax Brackets and How They Can Affect Small Businesses ...

- 2024 tax brackets: A look at the latest IRS tax bracket adjustments ...

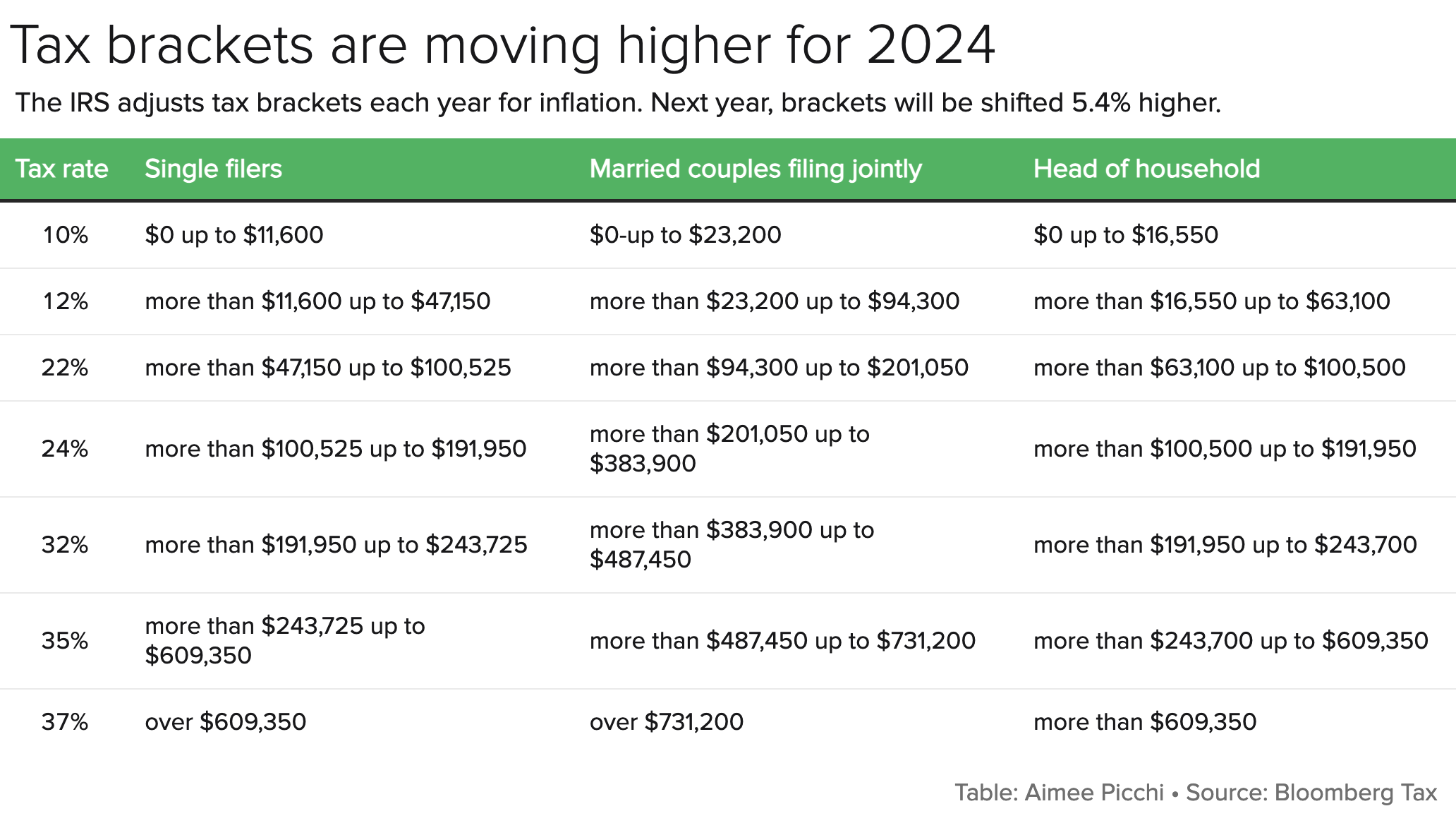

2024 IRS Tax Brackets: What's New?

Understanding Filing Statuses: Which One Applies to You?

Maximizing Tax Savings: Tips and Strategies

To minimize tax liabilities and maximize refunds, consider the following tips and strategies: Contribute to tax-advantaged accounts, such as 401(k) or IRA, to reduce taxable income. Itemize deductions, such as mortgage interest, charitable donations, and medical expenses, to claim more deductions. Take advantage of tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, to reduce tax liabilities. Consult a tax professional to ensure accurate filing and maximize tax savings. Navigating the 2024 tax landscape requires a thorough understanding of the IRS tax brackets and filing statuses. By staying informed about the updated tax brackets and rates, individuals and families can make informed decisions to minimize tax liabilities and maximize refunds. Remember to consult a tax professional to ensure accurate filing and maximize tax savings. Stay ahead of the tax game and make the most of the 2024 tax year.Keyword density: IRS tax brackets (1.2%), filing statuses (1.0%), tax rates (0.8%), tax savings (0.6%), tax landscape (0.4%)