Table of Contents

- Ray Dalio And The All Weather Way Investing

- Ray Dalio on If Your Life Has Crashed, You Need to Listen to This ...

- 'Pain is a great teacher': How Ray Dalio, the world's most successful ...

- Ray Dalio: U.S. Is 2 Years From Economic Downturn | TIME

- The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a ...

- RAY DALIO: There's one asset every portfolio must have | 15 Minute ...

- Extra: Ray Dalio Full Interview (Ep. 330) - Freakonomics Freakonomics

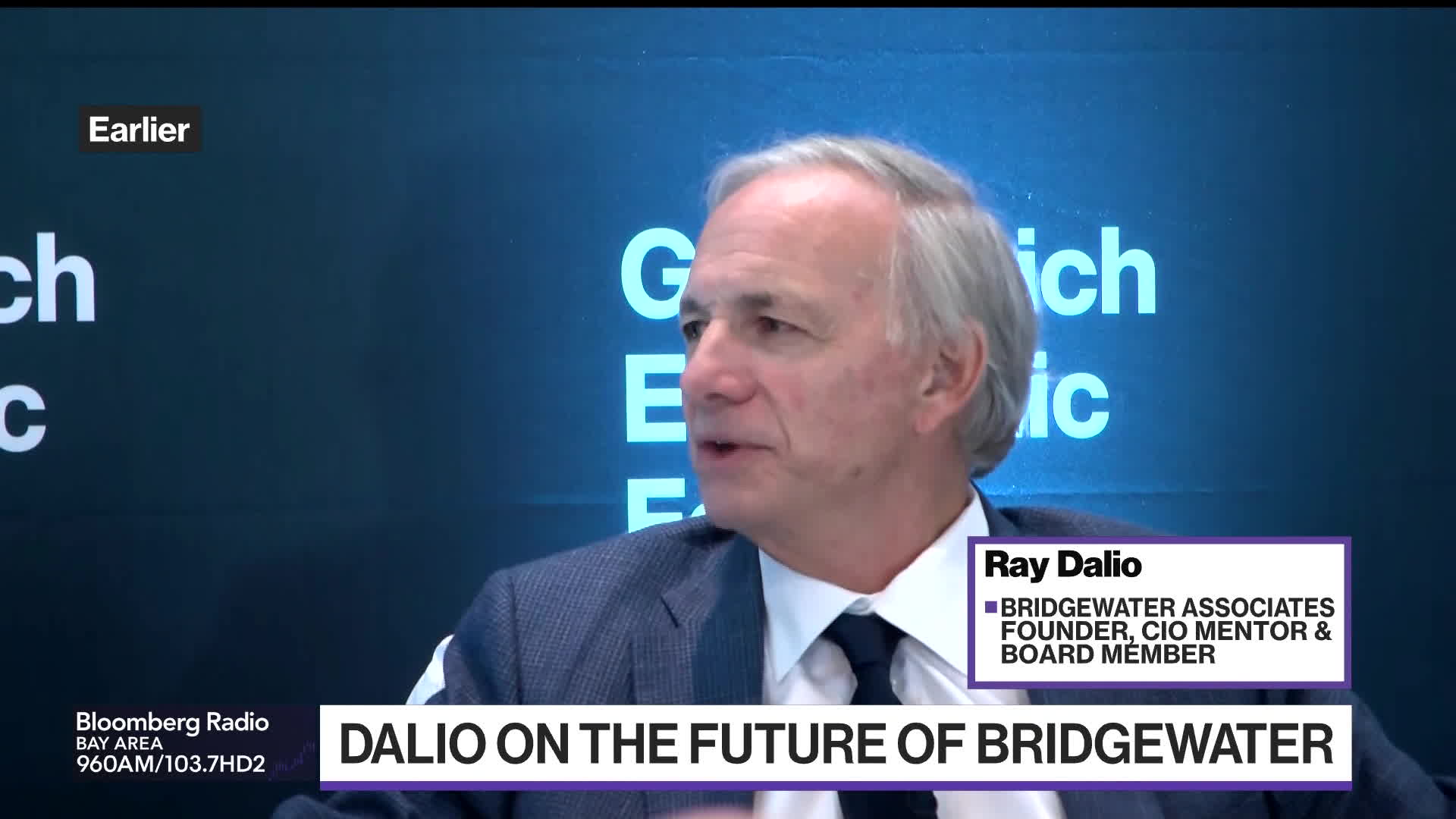

- Watch Ray Dalio on China's Economy, Future of Bridgewater - Bloomberg

- Ray Dalio: What Would Happen If You Were 100% Honest With Your ...

- Ray Dalio: U.S. Is 2 Years From Economic Downturn | TIME

The Debt Problem: A Ticking Time Bomb

Dalio's Warning: A Perfect Storm of Debt and Inflation

Potential Consequences: A Global Economic Downturn

If Dalio's warnings come true, the consequences would be severe. A U.S. debt crisis would lead to a loss of confidence in the dollar, causing a sharp decline in its value. This would lead to higher interest rates, making it more expensive for businesses and individuals to borrow money. The resulting economic downturn would be felt globally, as trade and investment flows slow down. The potential consequences include: A sharp decline in stock markets A rise in unemployment A slowdown in economic growth A potential currency crisis